By Glenn Klinksiek, Knowledge Center Content Manager, URMIA.

Summary

Summary

URMIA surveyed its members in May 2015 to find out whether URMIA member institutions are using controlled insurance programs successfully to manage risks and cost of construction projects. Construction is risky for many reasons--everything from construction worker accidents or I-beams falling on passersby to a catastrophic failure of a building system after construction is complete. The insurance costs embedded in project costs are significant.

A controlled insurance program (CIP) is defined as “a centralized insurance program under which one party procures insurance on behalf of all (or most) parties performing work on a construction project or on a specific site.” Commonly referred to as "wrap-ups," CIPs are most commonly used on single projects, but other uses include contract maintenance on a large plant or facility or on an ongoing basis for multiple construction projects ("rolling wrap-up"). Typically, the coverages provided under a CIP include builder’s risk (for construction wrap-ups), commercial general liability (CGL), workers compensation and umbrella liability. CIPs offer a number of benefits, including greater control of the scope of coverage, potentially lower project insurance costs and reduced litigation. CIPs can be purchased by the owner (OCIP/ROCIP) or contractor (CCIP) or a combination of participating parties.”1

The survey found:

- Of the respondents that considered a CIP, nearly two-thirds implemented a CIP. About 70 percent of the CIPs were owner-controlled insurance programs (OCIP).

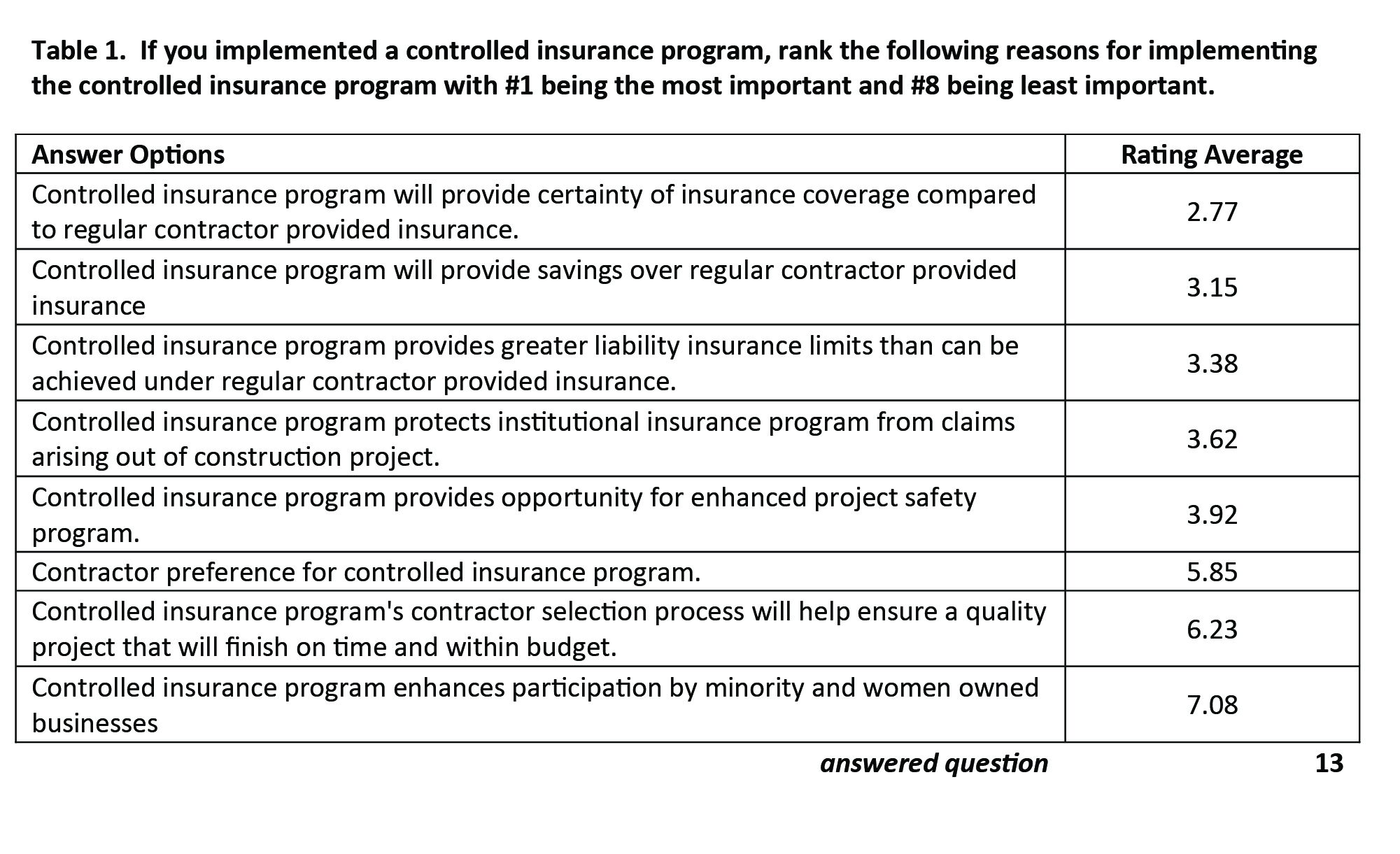

- For those that implemented a CIP, the top three reasons for doing so certainty of coverage, savings and greater liability limits.

- Survey participants anticipated a range of expense compared to the cost of traditional contractor-provided insurance from additional cost to a savings of more than five percent.

- Respondents are satisfied with their CIP; no one responded that they were not.

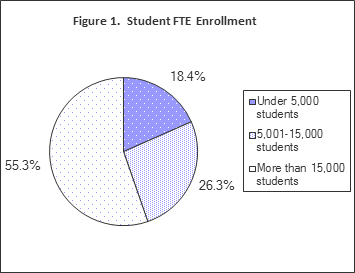

Survey response demographics

Forty-three persons took the survey. Responses were split fairly evenly between public and private institutions (45 percent and 55 percent respectively). Most respondents represent large institutions based on full-time equivalent (FTE) student count. This may reflect that larger institutions tend to have larger construction projects which may be more appropriate for CIPs.

Because the number of URMIA members that considered CIPs is unknown, the statistical significance of the survey results is impossible to state. Nevertheless, the survey results can be helpful to member institutions that are thinking about CIPS.

Prevalence of controlled insurance programs

Over half the respondents (22, or 51 percent) considered a CIP in the approximately three years from January 2012 to May 2015. Of those that considered a CIP, nearly two-thirds implemented a CIP (13, or 62 percent).

For those that implemented a CIP, the top three reasons for doing so certainty of coverage, savings and greater liability limits.2

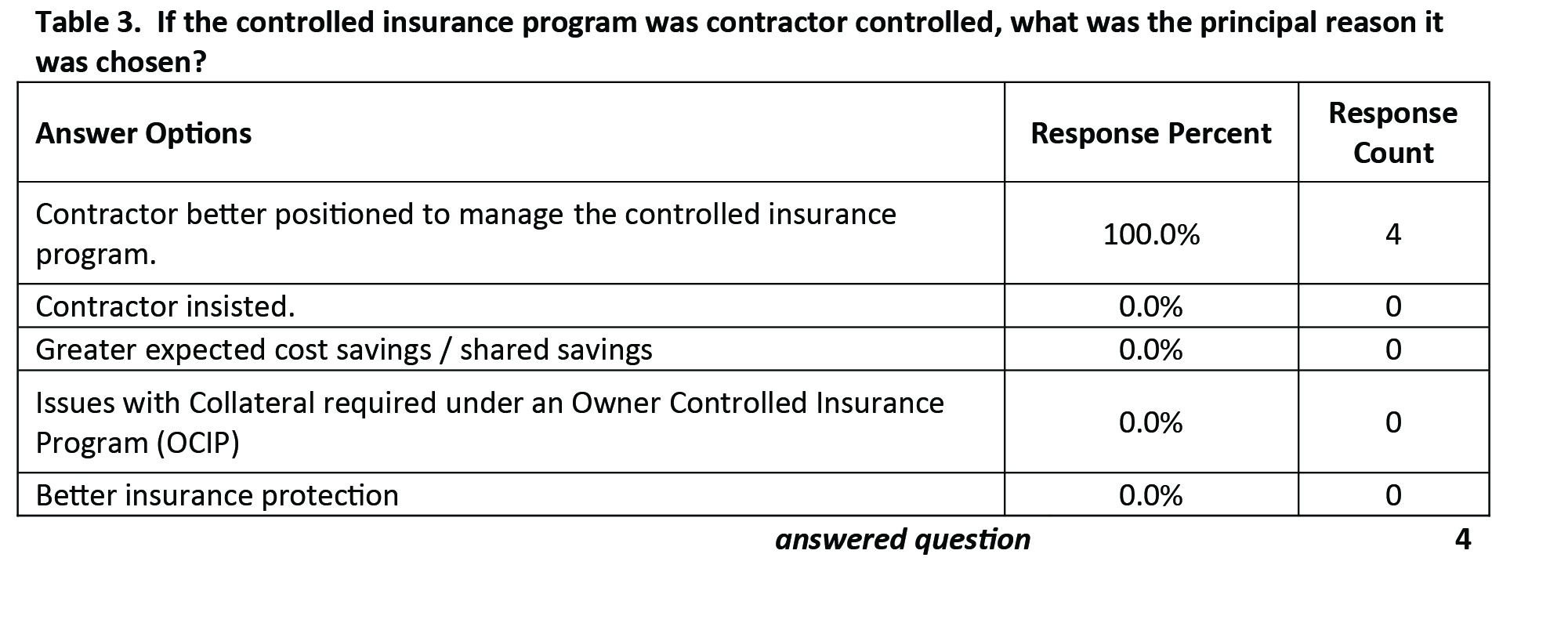

About 70 percent of the CIPs were controlled by the university, while 30 percent were controlled by the contractor.

The universities that implemented a contractor-controlled insurance program deemed that the contractor was better positioned to manage the CIP.

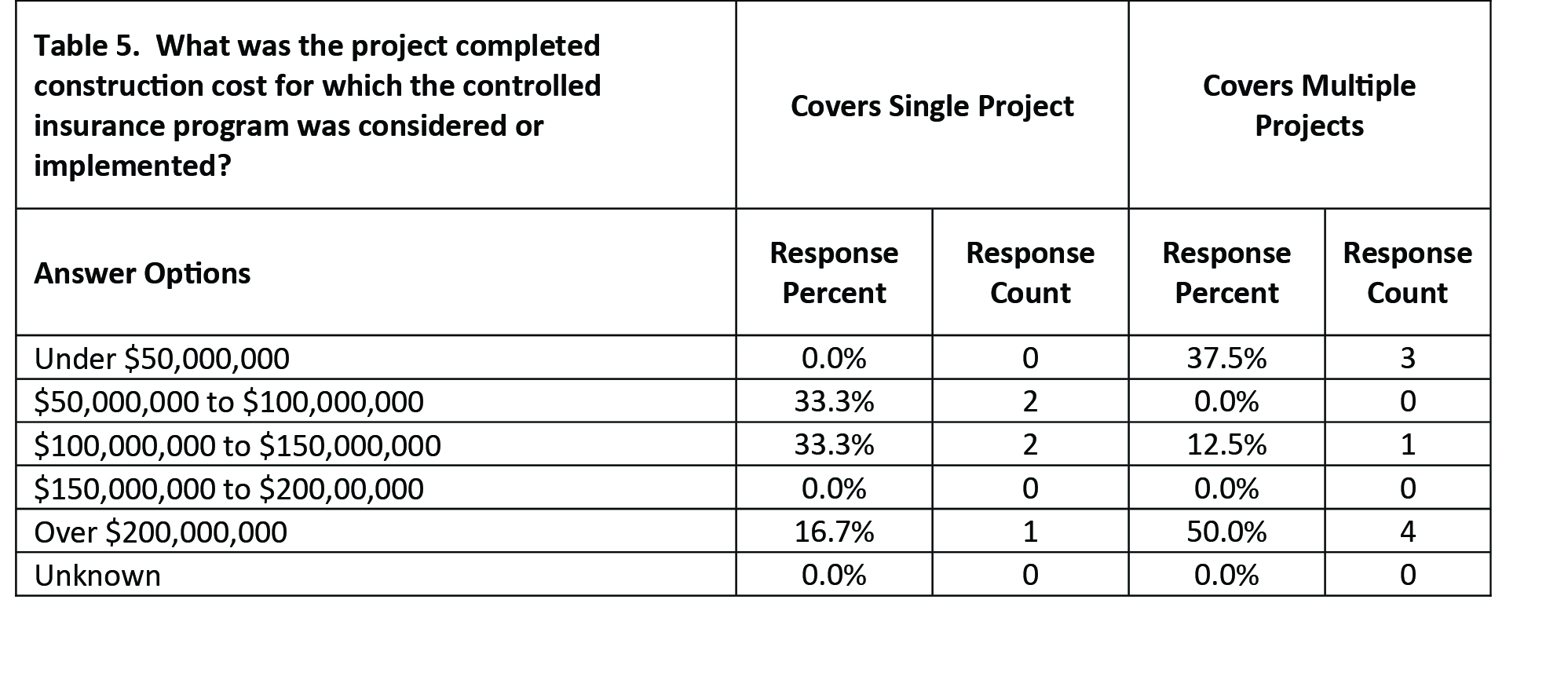

The CIPs were about evenly split between applying to a single project versus a program for multiple projects.

Respondents were asked what the project’s completed construction cost was for which the CIP was considered or implemented. For those who answered, the results showed a wide range of project sizes.

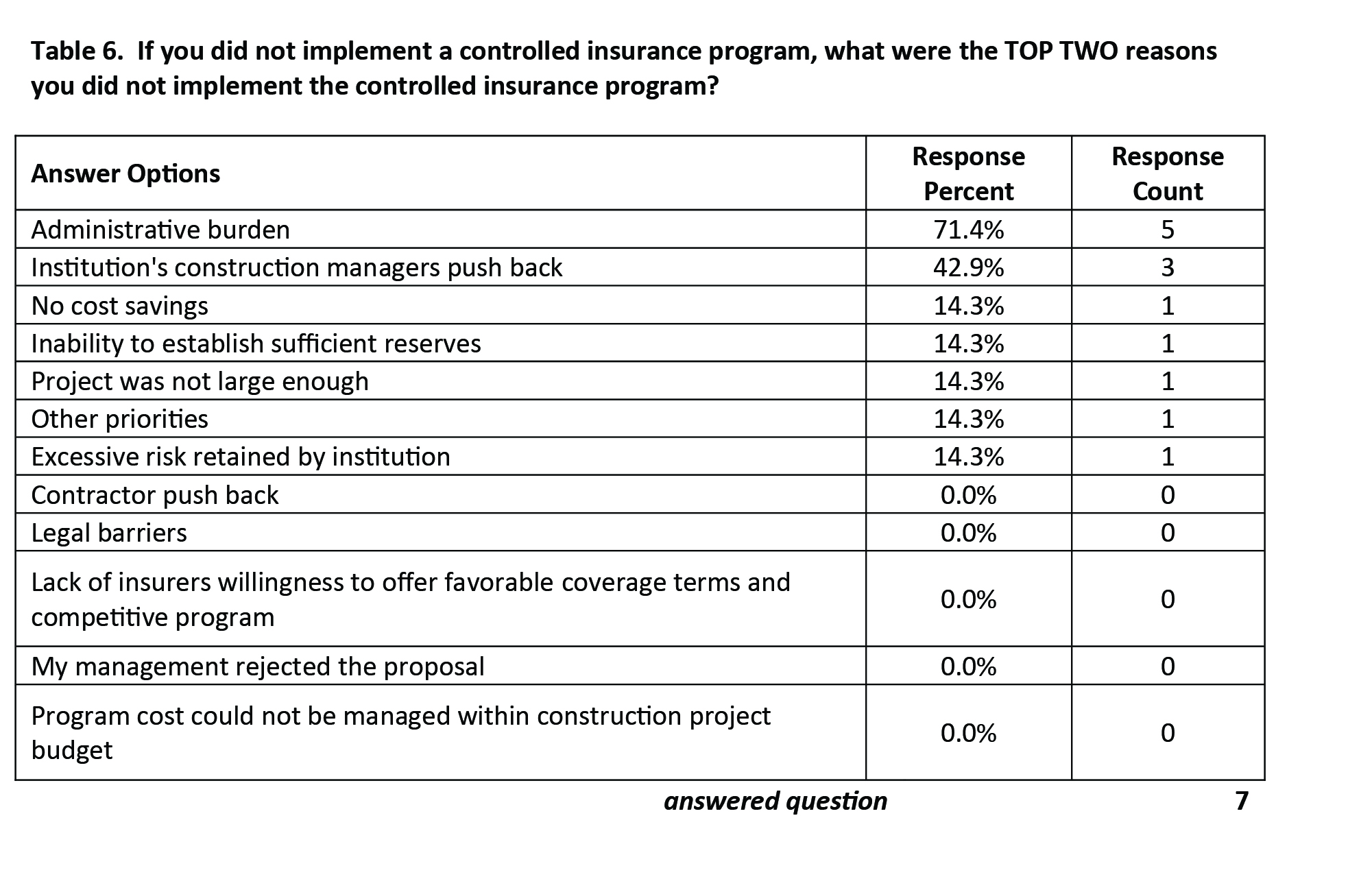

For those that did not implement a CIP, the top reason given was administrative burden.3

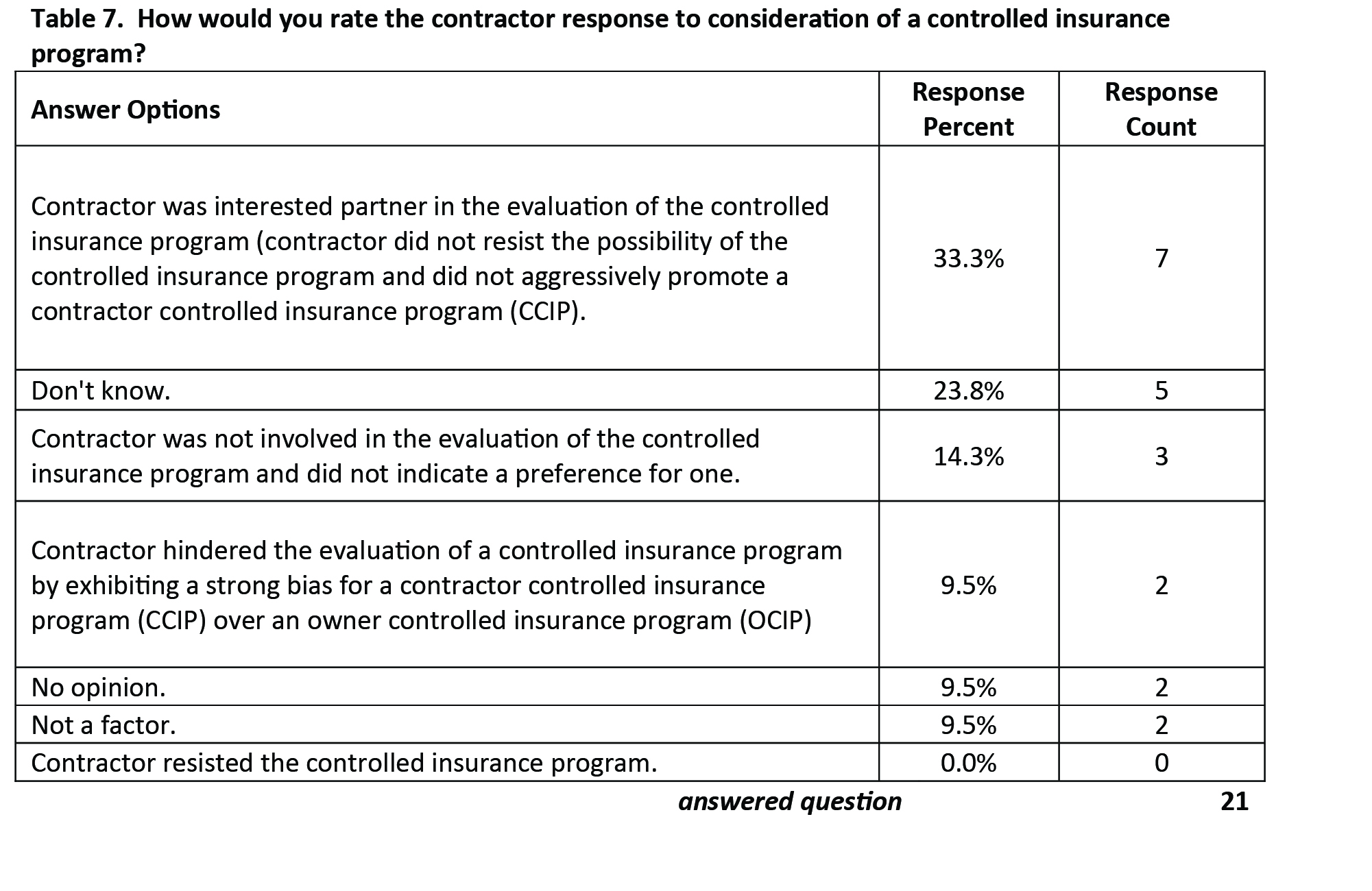

For those that considered a CIP, only two found that the contractor hindered the process while seven found that the contractor was an interested partner.

Controlled insurance program cost

The cost of CIPs depends on the design of the insurance program and the recognition of those costs in advance. Survey participants were asked what costs they included in their analysis. Most respondents considered broker fees, the cost of insurance, administration fees and claims within the deductible.

Survey participants anticipated a range of expense compared to the cost of traditional contractor-provided insurance from additional cost to a savings of more than five percent. Savings was defined as the reduction in construction project cost less cost as calculated using the relevant cost items listed above.

One cost element of CIPs is safety. The survey responses indicate that everyone made additional investment in safety for the covered construction work. Seven respondents of 10 said they were satisfied with the safety programs. One indicated an $80 million project was completed without a lost-time accident, while another indicated the program required significant involvement in safety to succeed.

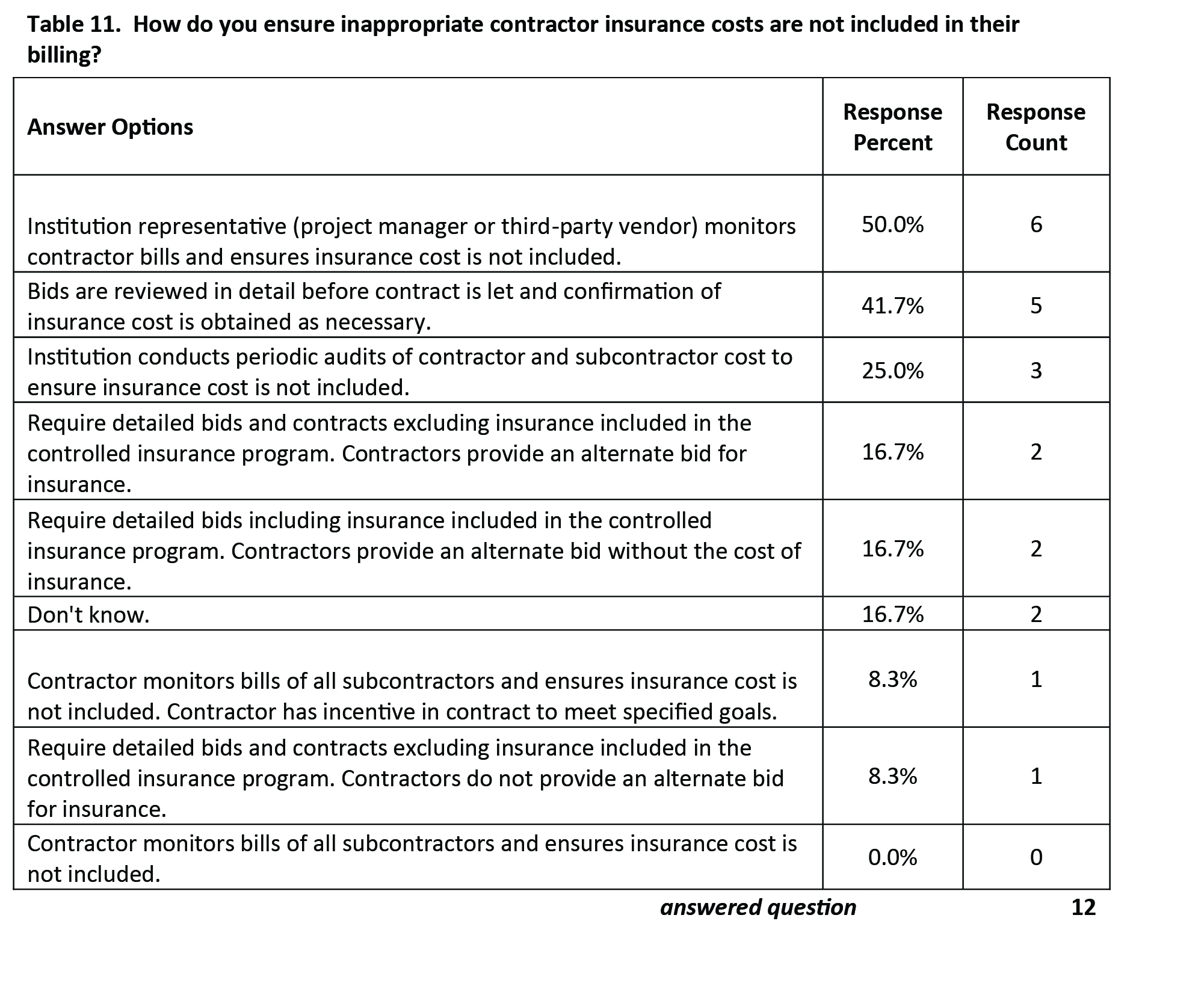

Survey participants were asked how they ensure they are not double paying for the cost of insurance, once to the CIP program and once to the contractors through inappropriate invoicing. The 12 responses did not indicate a preferred approach. Nearly all use more than one tactic to catch paying for contractor’s insurance in addition to the CIP cost. One respondent commented on the issue of double billing by saying “…our project teams feel contractors are not removing the costs and that we are paying for insurance twice. So the question ‘how do you know contractors are removing their insurance costs?’ -- you don't.”

Thoughts for future consideration of a controlled insurance program

Respondents were asked whether they were satisfied with their CIP. Of the 11 who responded, all said they were satisfied.

Respondents were also asked, “What advice would you share with an institution considering a controlled construction insurance program?” Twenty-three respondents gave the following guidance:

- Just do it; it’s a great solution.

- Hire a non-broker consultant to evaluate and monitor the OCIP.

- Understand the down side. You may not see savings in the first few years.

- In an OCIP, you drive claims process.

- Create financial incentives for the general contractor (GC) to meet certain safety targets.

- Keep evaluating as opportunity arises with your campus' master plan.

- Don't institute a program just for the projected savings.

- Don't count on WC savings.

- Our experience has been only with OCIP and we struggled with it; our employees and the contractors never embraced it. It would be difficult to sell it again on campus.

- Make sure you are adequately staffed to manage it. Don't count on brokers or accounting firms to have your best interests at heart. CIPs do have advantages but also high-level management challenges. Demand and do close out each project in no more than 45 days. Have it in the contract that if a job isn't closed out in that time, the insurer cannot charge AP.

- We had great success with OCIP in the early- to mid-2000s. It takes a lot of administrative effort, but significantly reduced claims on construction projects and resulted in significant cost savings. However, when considered at a large campus in a smaller town, it created great controversy with the local insurance agents who depend heavily on commission from premiums paid by contractors.

- Questionable since it puts you in charge of administering insurance for multiple contractors that you have no control over and who are contractually identified as separate independent contractors apart from your organization.

- Our construction management firm does not especially like them so if the institution uses one, the firm has to be sold. Also, we don't want our workers comp mod to be impacted.

- Consider all options. Hire a GC that is familiar with the program and has a successful safety program.

- Long education process to get all interested parties' buy-in. We are focusing on getting the best deal out of the CCIPs that are put in front of us.

- Understand how the deductions for the umbrella insurance will work. Be conservative with loss picks and retentions when you first enter into one. Understand that, initially, there is a LOT of administrative work, but it greatly lessons over time.

- Do homework before deciding.

- Manage expectations; be wary of broker promises. Speak to other institutions that have gone through wrap ups.

- Look at the total cost of insurance for these projects before considering an OCIP.

- It's worth evaluating. We're also looking at a GL-only CCIP for a project; it's slightly more expensive than a traditional (non-CIP) program, but it gives us some alignment of interests as to the safety programs.

- Watch your credits.

- Be sure to work with an experienced broker, with a quality team in place. You'll be glad you did when claims arise.

- Carefully compare the cost differential and the institution's administrative capacity to manage an OCIP.

2 Respondents were asked to indicate the insurance coverages included in their controlled insurance program; four responded. All included workers compensation, general and excess liability insurance. Two included builder’s risk and pollution coverage.

3 Two of the four institutions that implemented contractor controlled insurance program indicated several ways their institution was involved in the program.

Previous Article | Insights Home | Next Article